The spike in student visas in June 2024 forces the government to reevaluate its net migration control policies. Source nation trends and policy implications are indicated.

In order to reach its net migration prediction, the government will need to investigate innovative ways to lower application rates, while the number of student visas is rising. In June 2024, 45,992 student visas were issued. In order to reach the lower net migration prediction for 2024–2025, ministers expected a steeper decrease in application rates and higher refusal rates notwithstanding significant tightening of the student visa policy during the previous 12 months.

Visas for Students Abroad

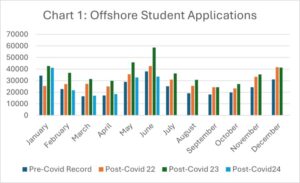

June 2024 saw 33,501 applications from overseas students, a substantial decrease from June 2023’s record of 58,526; June 2022’s level of 42,700; and June 2021’s pre-COVID high of 38,041. The sector that accounted for 75% of these applications was Higher Education, with a substantially higher approval rate (93.3%) than the sectors of Vocational Education and Training (V.E.T.) (41.6%) and English Language (77.7%), suggesting that the policy may be having the desired effect.

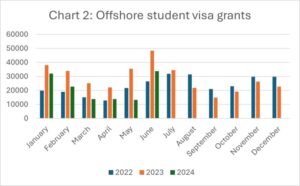

Grants for offshore students, however, totaled 33,777 in June 2024. Due to a notable increase in the approval rate from 72.6% in May 2024 to 88.4% in June 2024, this was considerably greater than the 26,430 grants in June 2022 even though it was still behind the 48,429 grants in June 2023. This increase points to a significant increase in July 2024 student arrivals, which will increase net migration, albeit not as much as in prior years.

This high number of offshore awards was made possible by higher grant rates for the majority of important source countries, including:

- China: 92.5% in May 2024 to 97.5% in June 2024

- India: 50% in May 2024 to 81.4% in June 2024

- Nepal: 70.4% in May 2024 to 89.8% in June 2024

- Pakistan: 15.1% in May 2024 to 46.6% in June 2024

- Sri Lanka: 72.7% in May 2024 to 84.3% in June 2024

- Bhutan: 59.8% in May 2024 to 90.2% in June 2024

It is not sustainable to maintain high rejection rates using subjective criteria, even with an increase in the number of visa processing professionals. This difficulty may account for a portion of the notable hike in student visa costs that will take effect on July 1, 2024. A more efficient strategy is required to strike a compromise between managing visa approvals and the goal of drawing in top-performing students.

Fascinating Patterns from Colombia and Bangladesh

Bangladesh, which is now ranked in the top five, is a significant source country. Bangladesh submitted 1,355 applications for offshore student visas in May 2024, and 1,883 applications in June 2024. From 87.4% in May 2024 to 96.8% in June 2024, the approval rate rose. The majority of Bangladeshi students enrolling in higher education, especially at Group of Eight universities with low risk ratings, is probably the reason for this high approval rate.

The biggest worry will be if the batch of Bangladeshi students continues to adhere to the terms of their visas and does not contribute to the increasing number of students who are in immigration limbo

Colombia suffered a dramatic decrease to 494 in June 2024 from 2,198 in June 2023, following a boom with around 24,000 applications for offshore student visas in 2022–2023 following COVID-19. For Colombian students, the offshore grant rate decreased from around 90% in 2022–2023 to almost 50% in the first half of 2024. The high risk rating of English language instructors and the recent rise in Colombian pupils’ requests for refuge are probably to blame for this reduction.

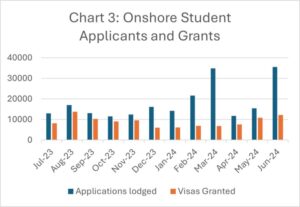

Student Visas for Onshore Study

The number of onshore student applications increased dramatically to 35,561 in June 2024, breaking the previous high of 34,888 in March 2024. Students who entered Australia on visitor visas and subsequently applied for onshore student visas to avoid higher offshore refusal rates—a method that was closed on July 1, 2024—are partially to blame for this spike, which is being pushed by V.E.T. and English language providers.

More than 62% of primary onshore student applications in June 2024 were for positions in the V.E.T. industry. In order to solve this, the government used largely subjective criteria to lower the onshore student grant rate from almost 90% in the first half of 2023–24 to about 70% in the second half. Due to this, the number of onshore student rejections that were appealed increased quickly, and a large number of those candidates are currently in the process of applying for bridging visas. Furthermore, the number of students requesting refuge is significantly increasing.

The current government’s tardy response to contain the boom and earlier policies that encouraged the application of student visas are to blame for the current state of affairs. Regaining control will take time and effort, and limiting the number of students at each provider might not be an effective long-term option.

Leave a Reply